World

UK’s Top Growth Stocks With High Insider Ownership August 2024

The UK market has faced recent challenges, with the FTSE 100 index closing lower due to weak trade data from China, highlighting global economic uncertainties. In such a climate, growth companies with high insider ownership can be particularly appealing as they often signal strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

|

Name |

Insider Ownership |

Earnings Growth |

|

Filtronic (AIM:FTC) |

28.6% |

33.5% |

|

Gulf Keystone Petroleum (LSE:GKP) |

12.1% |

74.6% |

|

Integrated Diagnostics Holdings (LSE:IDHC) |

26.7% |

23.5% |

|

Helios Underwriting (AIM:HUW) |

23.9% |

14.7% |

|

LSL Property Services (LSE:LSL) |

10.8% |

33.3% |

|

Belluscura (AIM:BELL) |

36.1% |

113.4% |

|

B90 Holdings (AIM:B90) |

24.4% |

142.7% |

|

Velocity Composites (AIM:VEL) |

27.6% |

188.7% |

|

Judges Scientific (AIM:JDG) |

11.9% |

27.5% |

|

Hochschild Mining (LSE:HOC) |

38.4% |

53.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Energean plc is involved in the exploration, production, and development of oil and gas, with a market cap of £1.76 billion.

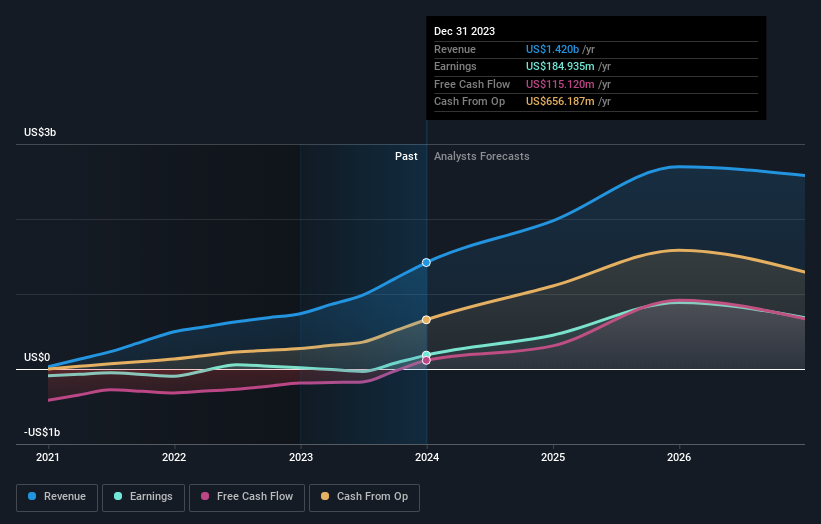

Operations: Energean’s revenue from oil and gas exploration and production amounted to $1.42 billion.

Insider Ownership: 10.6%

Energean has seen substantial growth, with earnings increasing by a very large percentage over the past year and forecasted to grow 14.56% annually. The company is trading at 53% below its estimated fair value, and insiders have been buying more shares than selling in recent months. Despite high debt levels and recent shareholder dilution, Energean’s revenue is expected to grow faster than the UK market. Recent expansions include the Cassiopea field start-up in Italy and the Katlan development project in Israel.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hochschild Mining plc is a precious metals company involved in the exploration, mining, processing, and sale of gold and silver deposits across Peru, Argentina, the United States, Canada, Brazil, and Chile with a market cap of £998.05 million.

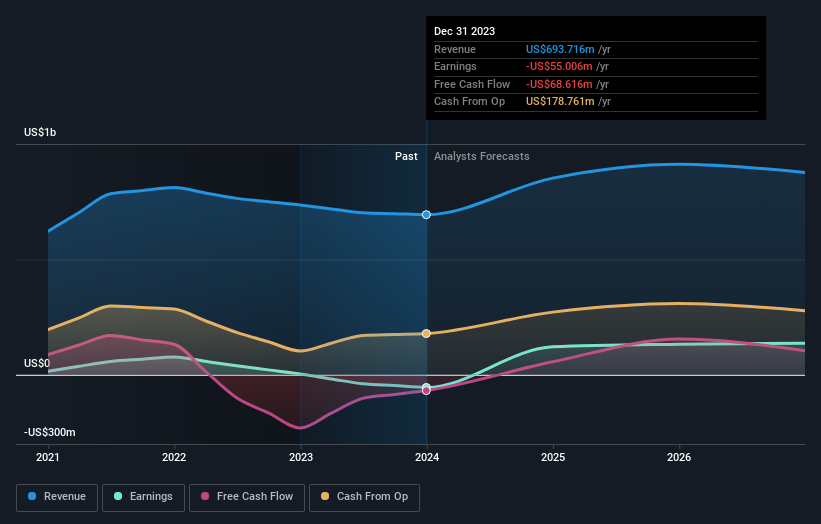

Operations: The company’s revenue segments include San Jose ($242.46 million), Inmaculada ($396.64 million), and Pallancata ($54.05 million).

Insider Ownership: 38.4%

Hochschild Mining is forecast to grow earnings by 53.78% annually and become profitable within three years, outpacing the UK market. Insiders have been buying more shares recently, with no substantial sales in the past three months. The stock trades at 35.5% below its estimated fair value and has high insider ownership. Recent results show increased gold production and reiterated production guidance for 2024 between 343,000-360,000 gold equivalent ounces.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: International Workplace Group plc, with a market cap of £1.83 billion, offers workspace solutions across the Americas, Europe, the Middle East, Africa, and the Asia Pacific through its subsidiaries.

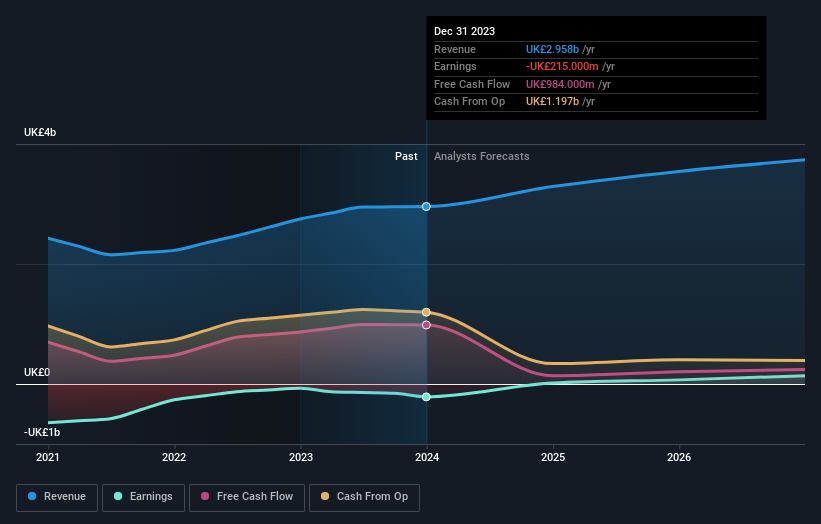

Operations: The company’s revenue segments include $1.29 billion from the Americas, $1.69 billion from Europe, the Middle East and Africa (EMEA), $400.56 million from Worka, and $341.30 million from the Asia Pacific region.

Insider Ownership: 25.2%

International Workplace Group (IWG) has seen significant improvements, reporting $16 million in net income for H1 2024 compared to a $75 million loss a year ago. The company forecasts robust annual earnings growth of 115.85% and revenue growth of 7.7%, outpacing the UK market average. Insiders have shown confidence by purchasing more shares than sold recently, though not in substantial volumes. IWG trades at good value relative to peers and is expected to become profitable within three years.

Make It Happen

Curious About Other Options?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include LSE:ENOG LSE:HOC and LSE:IWG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com