World

UK’s Top Dividend Stocks For September 2024

The UK market has experienced a downturn recently, with the FTSE 100 and FTSE 250 indices closing lower amid weak trade data from China. This economic backdrop highlights the importance of selecting dividend stocks that offer stability and reliable income streams.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| James Latham (AIM:LTHM) | 6.10% | ★★★★★★ |

| 4imprint Group (LSE:FOUR) | 3.33% | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | 7.28% | ★★★★★☆ |

| Man Group (LSE:EMG) | 5.87% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.32% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 5.79% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.85% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 3.42% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 5.23% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.46% | ★★★★★☆ |

Click here to see the full list of 59 stocks from our Top UK Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Vertu Motors plc operates as an automotive retailer in the United Kingdom with a market cap of £231.68 million.

Operations: Vertu Motors plc generates £4719.59 million in revenue from its retail gasoline and auto dealership operations.

Dividend Yield: 3.1%

Vertu Motors offers a mixed dividend profile with a low price-to-earnings ratio of 9x, suggesting good value relative to the UK market. While its dividends are well covered by both earnings (30.9%) and cash flows (12.4%), the track record is unstable and payments have been volatile over the past decade despite some growth. Recent board changes, including Ken Lever’s departure, could impact future governance and strategy.

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mears Group plc, with a market cap of £361.23 million, provides outsourced services to both public and private sectors in the United Kingdom through its subsidiaries.

Operations: Mears Group plc generates revenue from management services (£591.63 million) and maintenance services (£551.73 million) in the United Kingdom.

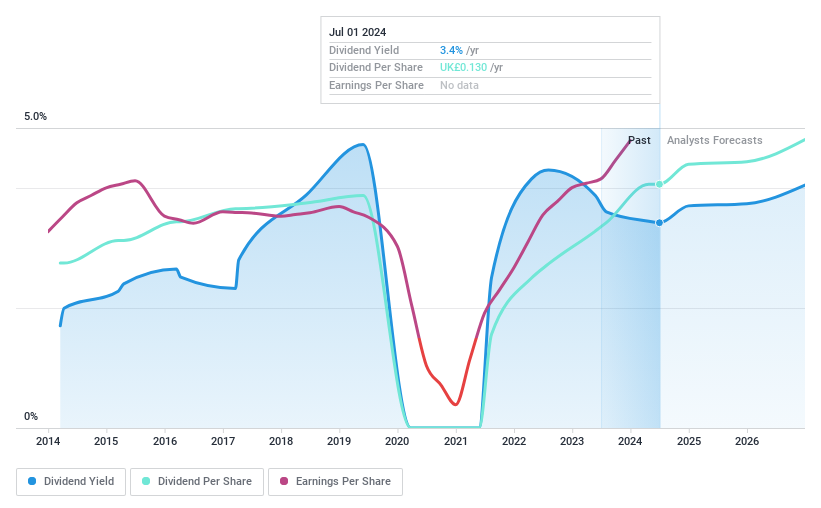

Dividend Yield: 3.6%

Mears Group’s dividends are well covered by earnings (33.4%) and cash flows (11.1%), indicating sustainability despite a volatile track record over the past decade. The recent interim dividend increase to 4.75 pence reflects positive performance, with half-year net income rising to £22.73 million from £16 million last year. Trading at a low P/E ratio of 8.8x, Mears offers good value compared to the UK market average of 16.5x, though future earnings are forecasted to decline by 14.7% annually over the next three years.

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Norcros plc, with a market cap of £210.10 million, develops, manufactures, and markets bathroom and kitchen products in the United Kingdom, Ireland, and South Africa.

Operations: Norcros plc generates £392.10 million in revenue from its Building Products segment.

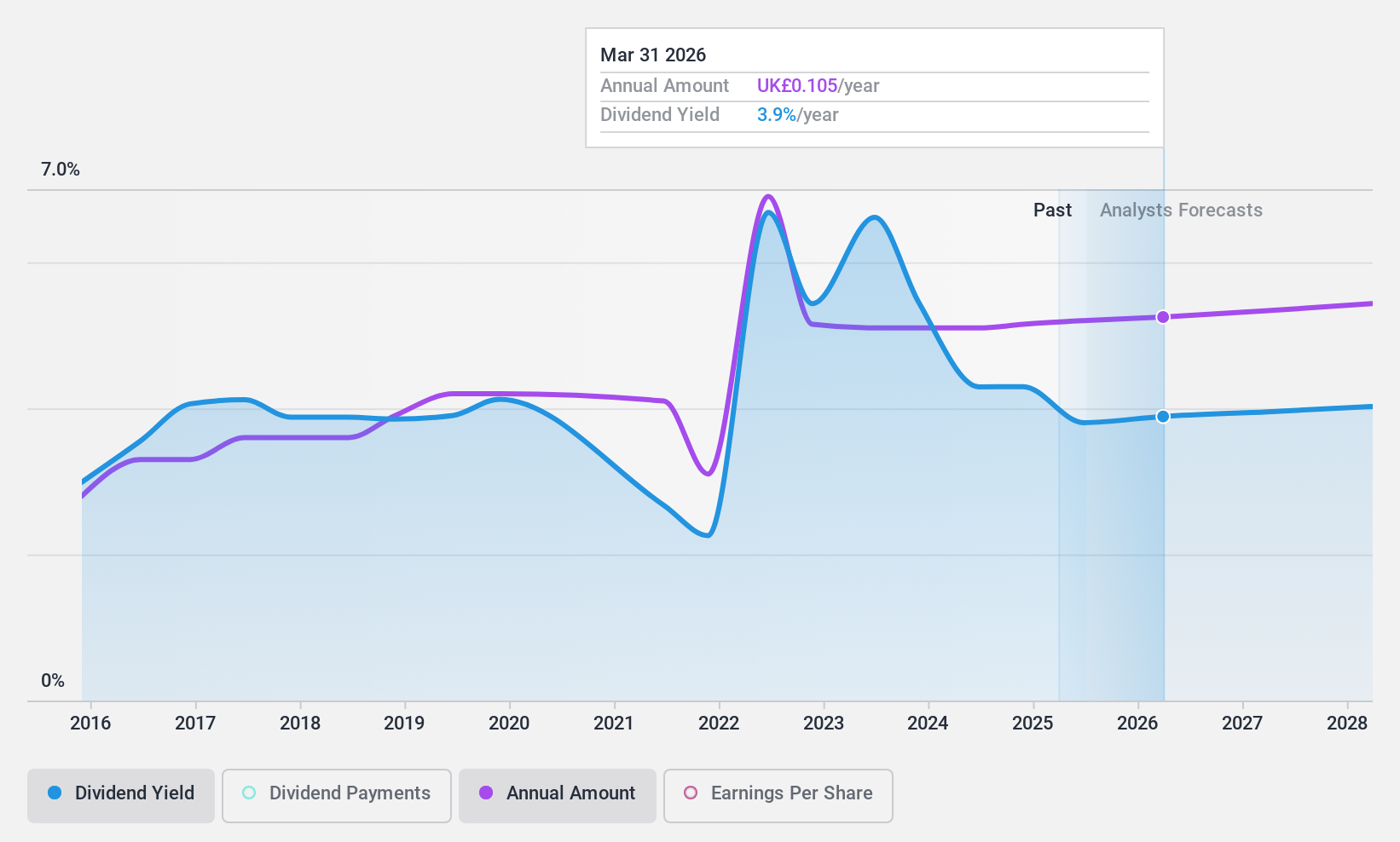

Dividend Yield: 4.4%

Norcros declared a final dividend of 6.8 pence per share, maintaining a total annual dividend of 10.2 pence, covered by earnings (33.9%) and cash flows (31.3%), despite volatile dividends over the past decade. The company reported full-year sales of £392.1 million and net income of £26.8 million, with earnings per share increasing to £0.301 from £0.191 last year but noted a revenue decline due to strategic exits from Johnson Tiles UK and Norcros Adhesives.

Taking Advantage

Searching for a Fresh Perspective?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com