World

Top UK Growth Companies With High Insider Ownership

The UK market has been experiencing turbulence, with the FTSE 100 closing lower due to weak trade data from China impacting companies tied to its economic fortunes. Despite these challenges, growth companies with high insider ownership can offer a unique investment opportunity, as insiders often have better insights and a vested interest in the company’s success.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.6% | 23.7% |

| Helios Underwriting (AIM:HUW) | 23.9% | 16.1% |

| Foresight Group Holdings (LSE:FSG) | 31.7% | 27.9% |

| LSL Property Services (LSE:LSL) | 10.8% | 33.3% |

| Belluscura (AIM:BELL) | 36.1% | 113.4% |

| B90 Holdings (AIM:B90) | 24.4% | 142.7% |

| Velocity Composites (AIM:VEL) | 27.6% | 188.7% |

| Beeks Financial Cloud Group (AIM:BKS) | 32.7% | 57.9% |

| Judges Scientific (AIM:JDG) | 11.9% | 26.9% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.1% | 80.6% |

Let’s uncover some gems from our specialized screener.

Simply Wall St Growth Rating: ★★★★☆☆

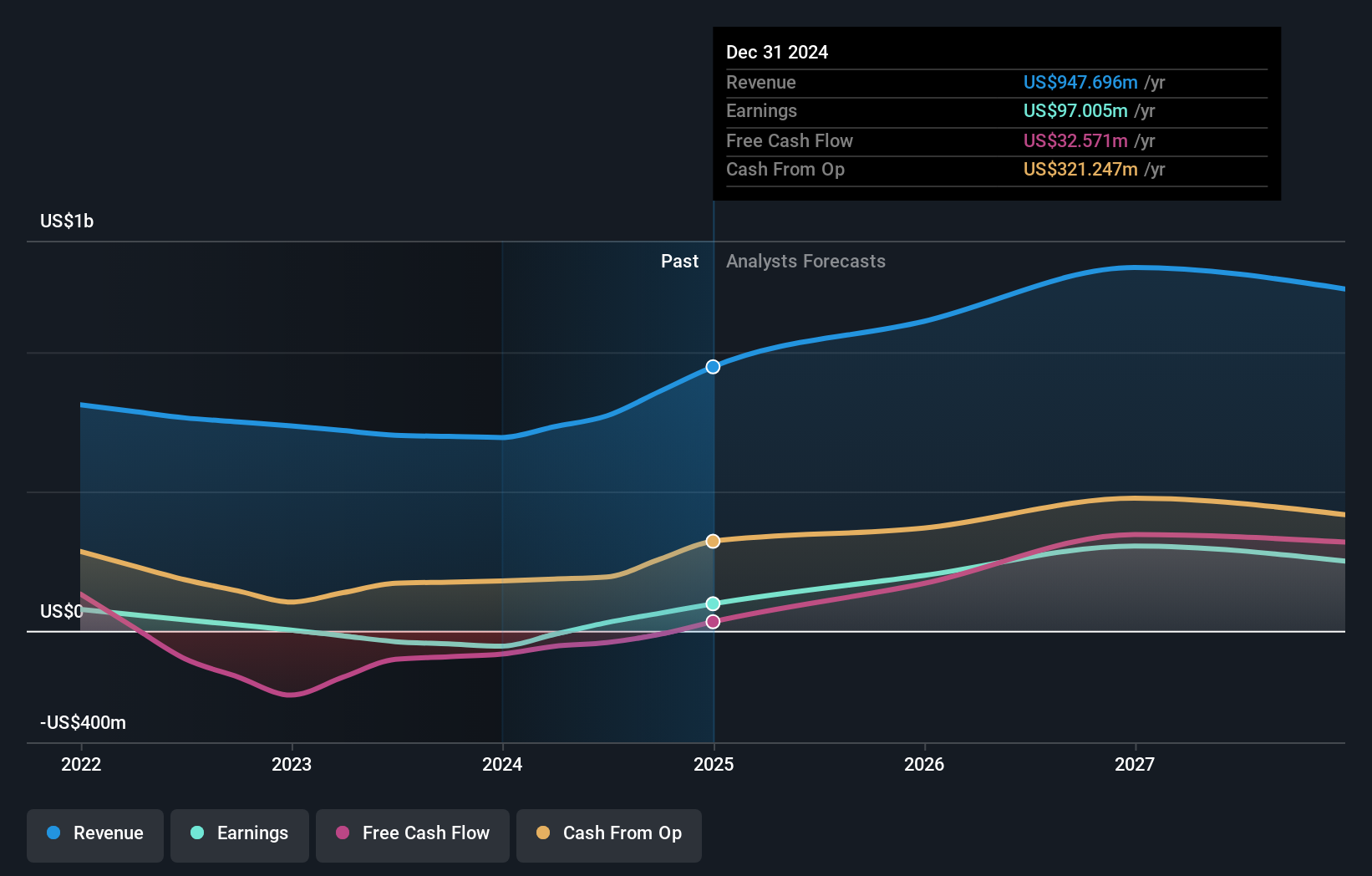

Overview: Craneware plc, with a market cap of £793.44 million, develops, licenses, and supports computer software for the healthcare industry in the United States.

Operations: Craneware generates $189.27 million in revenue from its healthcare software segment in the United States.

Insider Ownership: 17%

Craneware’s earnings grew by 26.8% over the past year, and its revenue is forecast to grow at 8.2% annually, outpacing the UK market’s 3.7%. Earnings are expected to rise significantly at 25.6% per year, surpassing market growth rates. Recent results showed sales of US$189.27 million and net income of US$11.7 million for FY2024, with continued focus on M&A opportunities and strategic collaborations like their recent partnership with Microsoft Azure for enhanced cloud capabilities and AI innovation in healthcare solutions.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Foresight Group Holdings Limited is an infrastructure and private equity manager operating in the United Kingdom, Italy, Luxembourg, Ireland, Spain, and Australia with a market cap of £587.75 million.

Operations: Revenue segments include £84.17 million from Infrastructure, £47.35 million from Private Equity, and £9.80 million from Foresight Capital Management.

Insider Ownership: 31.7%

Foresight Group Holdings’ earnings are forecast to grow significantly at 27.88% per year, outpacing the UK market’s 14.4%. Recent results showed revenue of £141.33 million and net income of £26.43 million for FY2024, with a dividend increase to 22.2 pence per share approved at the AGM. The company trades below its estimated fair value by 32.8% and has increased its equity buyback plan by £5 million, totaling £10 million in authorization.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hochschild Mining plc is a precious metals company involved in the exploration, mining, processing, and sale of gold and silver deposits across Peru, Argentina, the United States, Canada, Brazil, and Chile with a market cap of £848.86 million.

Operations: Hochschild Mining generates revenue primarily from its San Jose segment with $266.70 million and its Inmaculada segment with $451.91 million, totaling significant contributions to the company’s financial performance.

Insider Ownership: 38.4%

Hochschild Mining’s recent earnings report highlights significant growth, with H1 2024 sales at US$391.74 million and net income of US$39.52 million, reversing a prior net loss. The company became profitable this year and is forecasted to grow earnings by 43.79% annually over the next three years, outpacing the UK market’s average growth rate. Despite high debt levels, it trades at 67.2% below estimated fair value with analysts expecting a 41.3% price increase.

Next Steps

Seeking Other Investments?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders.

It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities.

All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com