World

The UK funds with the best risk-adjusted returns over five years | Trustnet

Aggressive funds proved most popular, with the best performers generally taking the most risks.

The UK market is a headscratcher. Just a few months ago there was renewed optimism for UK equities, with suggestions that it might even be time for a more patriotic punt at the UK market, but fast forward to last month and UK sectors were three of the top five worst-performing Investment Association peer groups with returns down by 1.2% in the IA UK All Companies sector.

For investors willing to take the risk of putting their money in the domestic market, making the most out of the risks you take is seemingly essential.

In the second part of our ongoing series, Trustnet examines the funds making the best risk-adjusted returns over the past five years. We do this by examining the portfolios that have a top-decile Sharpe Ratio, a measure of the excess return generated per unit of risk, over five years relative to their peers, as well as those making the highest total returns over the period.

Below, we look at the best funds for risk-adjusted returns in the IA UK All Companies sector.

Risk-adjusted returns of IA UK All Companies funds over 5yrs

Source: FE Analytics. Total return in Sterling. Figures accurate up to 30 September 2024

While portfolios can achieve top decile risk-adjusted returns by taking less risks for more reasonable returns, it has been the most aggressive strategies which shined in the UK over the past five years.

Heading up the list is the £1.5bn Invesco UK Opportunities fund, managed by Martin Walker. With an FE Fundinfo crown rating of five, it has enjoyed a top-decile five-year performance of 68.7% and sixth-decile volatility of 17%.

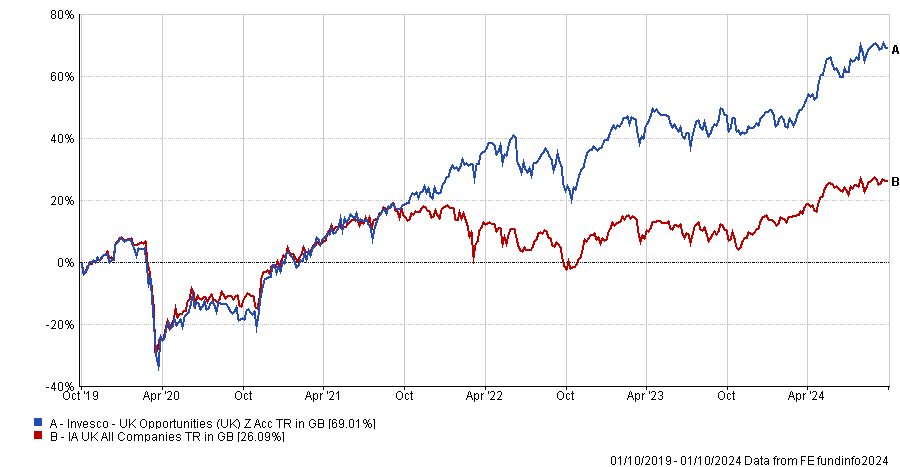

Performance of fund vs sector over 5yrs

Source: FE Analytics

This relatively bullish strategy proved highly effective, with the fund achieving the best Sharpe ratio in the wider peer group of 0.44 over five years.

It enjoyed impressive annual results during this period, with the fund up by 10.4% in 2022, the best performance in the wider sector.

For the team at RSMR, the fund’s strong performance makes it highly recommended to hold for investors’ UK equity allocations.

Analysts at the firm said: “The Invesco UK Opportunities fund has been managed with a consistent, large-cap, valuation-led strategy for many years, producing strong risk-adjusted returns for investors. Bottom-up fundamental proprietary research leads to a high-conviction fund that should outperform the peer group average over a full cycle.”

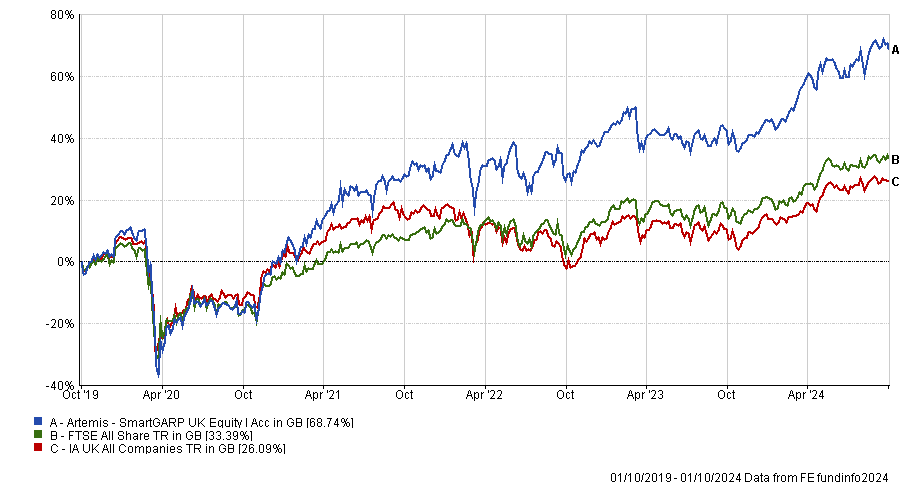

Next is the £470m Artemis SmartGARP UK Equity portfolio, which had the second-best five-year performance in the peer group, rising 69.6%. It has combined this with eighth-quartile volatility of 19.2%, making it one of the most aggressive strategies in the sector over the past five years.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

This high-risk, high-reward strategy worked well, with the fund achieving the second-best five-year Sharpe ratio at 0.4. Its broader performances also proved exceptional, with top-quartile results over the past one, three, and 10 years despite high volatility. Over 10 years, it delivered the third-best effort in the whole sector, with a performance of 138.5%.

Nevertheless, it has not been entirely smooth sailing for the portfolio, with the fund underperforming in 2023 when it rose by just 3.6% compared to a 7.9% sector average.

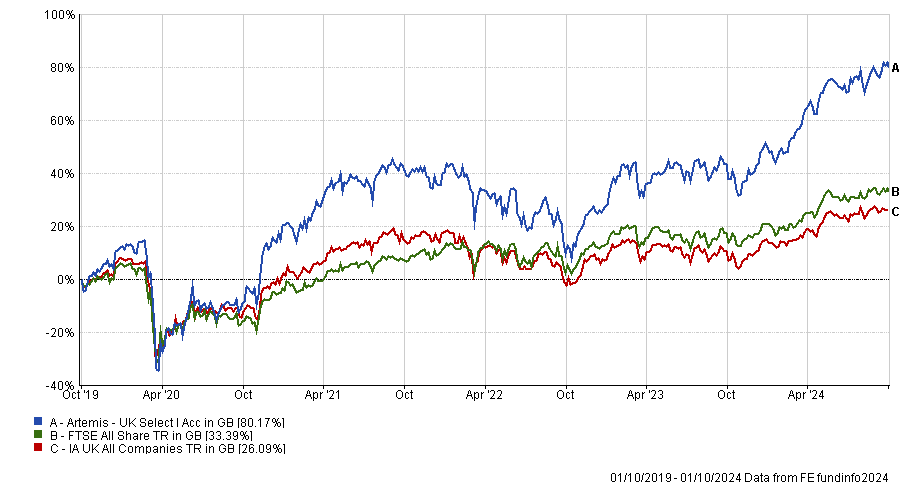

Finishing off the top three portfolios for risk-adjusted returns was another Artemis strategy, the £2.5bn Artemis UK Select fund, co-managed by Ambrose Faulks and FE Fundinfo Alpha Manager Ed Legget.

With top-decile returns of 80.5% over five years, it was the best fund in the peer group for pure performance. Moreover, with a five-year volatility of 23.1%, it was also the 10th most aggressive fund in the sector.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

At a Sharpe ratio of 0.39, it was the third-best portfolio for risk-adjusted returns in the wider peer group. Consequently, despite taking the most risks on our list, it managed to make supranormal returns to compensate investors.

While aggressive strategies generally delivered strong risk-adjusted returns in the UK, more moderate strategies also had their place. One such example is the £3bn Royal London Sustainable Leaders Trust, which is one of the larger portfolios in the sector.

Top-decile performance of 41.6% over five years was matched by a first-quartile ranking of 13.8% in volatility, leading to a total Sharpe Ratio of 0.27.

In a sector where the more aggressive strategies seemed to be in vogue, it stands out for its risk-adjusted returns while taking minimal risks.

Previously in this series, we have looked at the IA Global Sector

![No Verification Casino UK: Best No KYC Casinos [year] No Verification Casino UK: Best No KYC Casinos [year]](https://www.spieltimes.io/wp-content/uploads/2024/09/casino.webp)