World

The best UK stock-pickers this year | Trustnet

The FTSE 100 is having its best year since 2021 with 18 stocks returning more than 30% and outperforming the mighty S&P 500.

Some 48 stocks in the FTSE 100 have delivered double-digit returns this year and 18 UK-listed companies have surged more than 30%, even beating the S&P 500. NatWest and Rolls-Royce are the top performers, up 99.3% and 95.7% this year to 6 December, according to data from AJ Bell.

For fund watchers, this begs the question of which managers were insightful or lucky enough to hold the year’s best-performing stocks.

The UK’s best-performing stocks this year

Sources: AJ Bell, ShareScope, data to market close on 6 Dec 2024, total return with dividends reinvested

Within the IA UK All Companies sector, the fund currently owning more of the 18 top performers than anyone else is Artemis UK Select, which holds Barclays, Standard Chartered, NatWest, Rolls-Royce, 3i Group and DS Smith in its top 10.

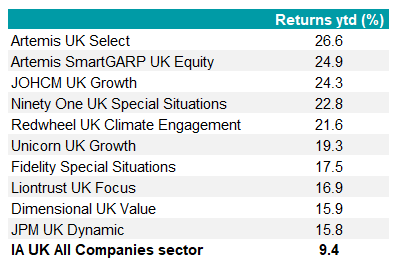

Astute stock selection powered the fund to the top of its peer group, as the table below shows.

Best-performing funds in the IA UK All Companies sector this year

Source: FE Analytics, data to 17 Dec 2024

Artemis UK Select, which is managed by Ed Legget and Ambrose Faulks, was also the second-best performer in its sector for 2023, only beaten by Ninety One UK Special Situations. It topped its peer group over the five years to 16 December 2024 and was in third place over three years.

The fund has a fairly concentrated portfolio of 40-50 stocks and, although it is a multi-cap strategy, it currently has a bias towards large-caps.

Legget told Trustnet in September that UK banks were incredibly undervalued and that Natwest had made the greatest contribution to the fund’s performance in the 12 months to 31 August.

Rolls-Royce, another top contributor, has more potential to deliver growth across its civil aerospace, defence and power systems businesses, he said.

This year’s second-best stock-picker is JOHCM UK Dynamic. It owns four winning stocks within its top 10: Barclays, Beazley, Rolls-Royce and Standard Chartered.

JOHCM UK Dynamic used to be managed by Alex Savvides, whose move to Jupiter Asset Management was announced in January 2024.

Mark Costar and Vishal Bhatia, who were already managing JOHCM UK Growth, were handed the UK Dynamic mandate; Tom Matthews, an analyst on UK Dynamic for eight years, joined them.

JOHCM UK Growth, which has Standard Chartered in its top 10, is the third-best performing fund in its sector this year.

Looking at the latest data for funds’ top 10 holdings has its drawbacks. The data does not reveal whether managers have held these stocks all year or bought them recently, missing some of the run. It also fails to show whether other managers held large stakes in these companies earlier in the year but took profits.

However, there is a clear link between the funds that outperformed their peers by the widest margin and those placing substantial bets on the year’s biggest winners.

Fidelity Special Situations, Ninety One UK Special Situations and Redwheel UK Climate Engagement all performed strongly in 2024 and hold three of the 18 highest returning stocks within their top 10 positions.

Fidelity Special Situations holds Imperial Brands (its largest overweight), Natwest and Standard Chartered. Ninety One UK Special Situations owns Natwest, Rolls-Royce and Beazley. Redwheel UK Climate Engagement has the banking trifecta of Natwest, Barclays and Standard Chartered.

Other funds with large stakes in three of this year’s winners include JPM UK Equity Growth, Royal London UK Dividend Growth and the Royal London UK Growth Trust.

As for this year’s top-performing stocks themselves, NatWest improved it margins and benefitted from growth in lending and savings deposits, leading to regular upgrades to earnings forecasts during the year. It also acquired of assets from Sainsbury’s Bank and Metro Bank, said Dan Coatsworth, investment analyst at AJ Bell.

“A major share overhang was lifted as the government accelerated the sale of what was a large stake in the business following a bailout in the global financial crisis. The stake is now less than 11% versus 38% a year earlier and the government has indicated it will be out completely next year,” he explained.

Rolls-Royce, whose share price was also boosted by upgraded earnings forecasts, is “a true phoenix from the ashes story”, he continued.

“Having disappointed for years on cash flow, Warren East laid the foundations for running a tighter ship at Rolls-Royce, but his successor Tufan Erginbilgiç is the one basking in all the glory for this grand turnaround.”

A recovery in the aviation industry has helped. “The amount of time planes fly in the sky has a direct impact on the amount Rolls-Royce makes on spares and repairs contracts for a large installed base of aircraft engines. This installed base itself is also growing. Airlines are investing heavily to expand their fleet as they add new routes and seek more energy-efficient planes.”

Furthermore, the company’s defence business has prospered on the bank of increased military spending. “The new UK government is pro-nuclear power which plays to Rolls-Royce’s strengths as Labour has shown interest in small modular reactors, something the engineer has been developing. It has designed a factory-built nuclear power plant that it believes will offer clean, affordable energy ‘for all’,” Coatsworth noted.