World

Parents of SEND pupils at ‘breaking point’ over private VAT hike

BBC

BBCPupils with special educational needs and disabilities (Send) might lose their extra support at private schools once a 20% VAT is introduced.

Some parents of Send pupils say they already at “breaking point” financially.

Mum-of-three Rebecca, from Somerset, believes the new fees are “unfair”, she said: “If they can guarantee my child will turn up at a state school and they will get the help they need, I have no problem. But they can’t.”

The government said the VAT rise is needed to improve education for the 93% of pupils outside the private system.

The government spokesperson added that students with an Education, Health and Care Plan (EHCP), which states their needs cannot be met in the state sector, will have their private school fees paid by the local authority and will be able to reclaim the VAT fee.

However, not all Send pupils have EHCP’s, which has resulted in some parents paying the fees with their own money to ensure their children’s needs are being met.

The VAT rise will be added to private school fees from January 2025.

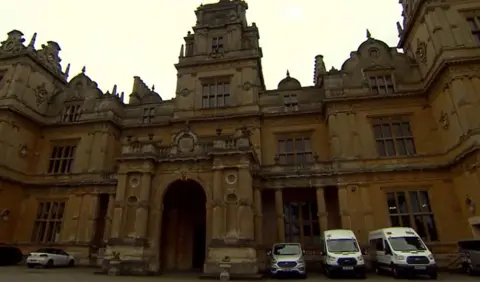

The BBC spoke to parents who have Send children at Westonbirt School in Tetbury, Gloucestershire, and Wellington School, in Somerset.

Rebecca chose Wellington School because of its reputation for being “caring and diverse”. All of her children have special educational needs but do not have EHCPs.

She is “frightened” by the additional £9,000 a year she has estimated she will have to pay on top of the current £60,000.

Without being at the private school, Rebecca fears her youngest child, who has a neurodiverse condition, could be placed in a residential care unit due to losing the “stability and extra attention Wellington School provides”.

Her son, who has a hearing condition, had previously been bullied in a state school.

She considers herself an “average earner”, and the family has already been eating into an inheritance received from her husband’s late parents to pay the fees at their current level.

“This year our holiday was to Milton Keynes – to visit an audiologist for Ellia and Max. We don’t live a luxurious lifestyle.

“Our shoulders are not big enough. I can’t get into a [state] school and none of them are able to cater for my children’s requirements,” she added.

Send students make up a third of Westonbirt School’s population and leaders said it has already lost about “three or four pupils” as a direct result of the VAT changes.

“There are better ways of asking more of us. It would be brilliant to be doing more with bursaries from the local authority, and do that with the government rather than working against it,” said headteacher Natasha Dangerfield.

One mother Henny said she can “just about weather the storm”.

“The added cost pressures are going to limit the number of jobs I can create at my marketing agency, where almost all the profits have been ploughed back into my dyslexic children’s education,” she said.

She had been been trying to secure places at various alternative state schools to Westonbirt, but could not get in anywhere.

‘Best chance in life’

Recent polling, conducted by Ipsos at the end of August, suggests 55% of Britons support Labour’s plan to impose VAT on private schools, with only 19% opposed.

During the election campaign, Sir Keir Starmer insisted he had “nothing against” them, but that his greater priority would be to fund a promised 6,500 new teachers in the state sector.

A government spokesperson said: “We want to ensure all children have the best chance in life to succeed.

“Ending tax breaks on private schools will help to raise the revenue needed to fund our education priorities for next year, such as recruiting 6,500 new teachers.”