World

UK’s Top Undervalued Stock Estimates For September 2024

The recent performance of the FTSE 100 and FTSE 250 indices has been impacted by weak trade data from China, highlighting ongoing challenges in global markets. Despite these headwinds, identifying undervalued stocks can present unique opportunities for investors looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Integrated Diagnostics Holdings (LSE:IDHC) | US$0.374 | US$0.73 | 48.7% |

| Liontrust Asset Management (LSE:LIO) | £6.19 | £12.31 | 49.7% |

| Topps Tiles (LSE:TPT) | £0.4755 | £0.91 | 47.5% |

| AstraZeneca (LSE:AZN) | £131.90 | £250.06 | 47.3% |

| Mercia Asset Management (AIM:MERC) | £0.358 | £0.68 | 47.4% |

| Ricardo (LSE:RCDO) | £5.10 | £10.13 | 49.6% |

| Velocity Composites (AIM:VEL) | £0.42 | £0.82 | 48.9% |

| Tortilla Mexican Grill (AIM:MEX) | £0.51 | £1.01 | 49.4% |

| Foxtons Group (LSE:FOXT) | £0.632 | £1.21 | 47.8% |

| Forterra (LSE:FORT) | £1.74 | £3.48 | 49.9% |

Let’s take a closer look at a couple of our picks from the screened companies.

Overview: Fintel Plc provides intermediary services and distribution channels to the retail financial services sector in the United Kingdom, with a market cap of £319.84 million.

Operations: Fintel Plc generates revenue through three main segments: Research & Fintech (£22.30 million), Distribution Channels (£20.20 million), and Intermediary Services (£22.40 million).

Estimated Discount To Fair Value: 22.5%

Fintel (£3.07) is trading at a 22.5% discount to its estimated fair value of £3.96, indicating it is undervalued based on cash flows. While earnings are forecast to grow significantly at 23.88% per year, revenue growth is slower at 8.6% per year but still outpaces the UK market’s 3.7%. However, large one-off items have impacted financial results and Return on Equity is expected to be low (12.8%) in three years.

Overview: Victorian Plumbing Group plc is an online retailer of bathroom products and accessories in the United Kingdom with a market cap of £322.44 million.

Operations: The company’s revenue from online retailing of bathroom products and accessories in the United Kingdom amounts to £282.90 million.

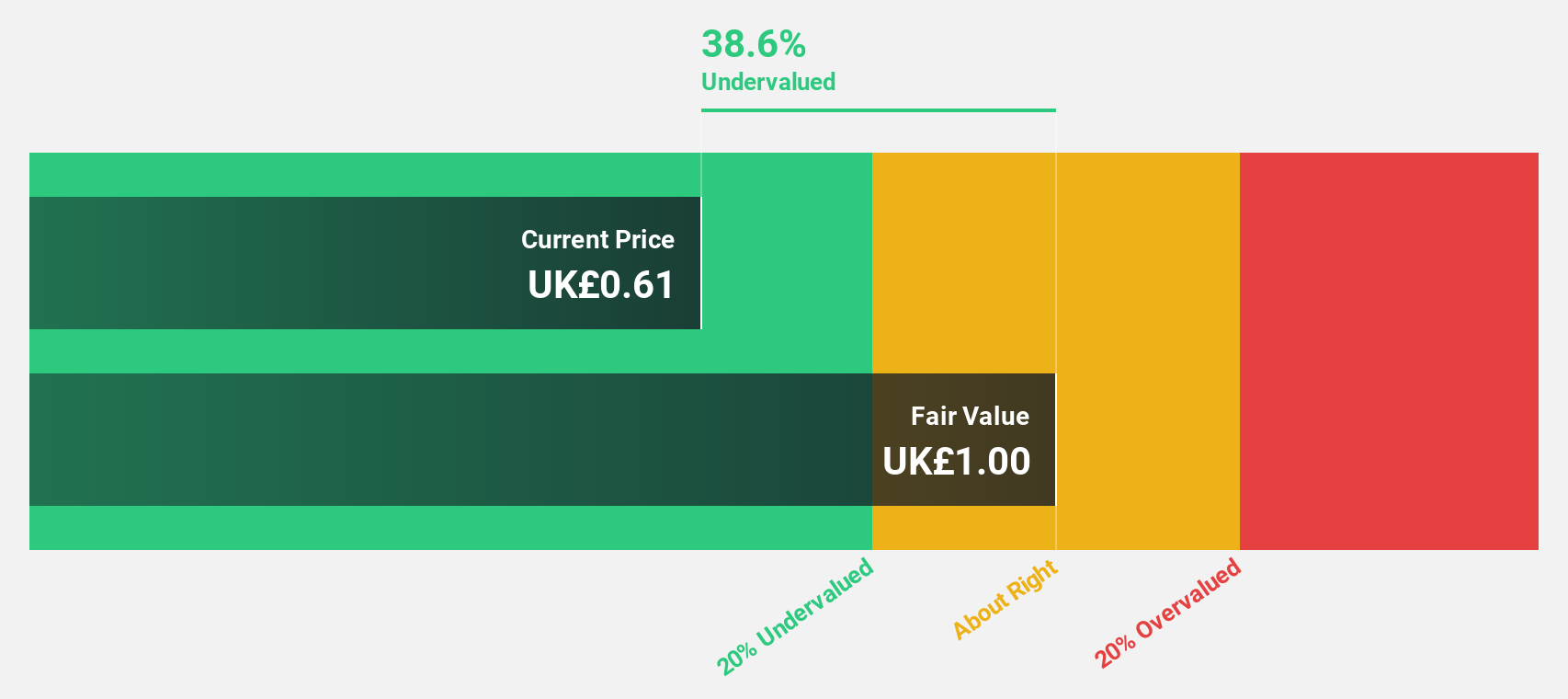

Estimated Discount To Fair Value: 24.6%

Victorian Plumbing Group (£0.99) is trading 24.6% below its estimated fair value of £1.31, highlighting its undervaluation based on cash flows. Earnings are forecast to grow significantly at 33.9% per year, outpacing the UK market’s 14.4%. Revenue growth is also expected to be robust at 9.9% annually, faster than the broader market’s 3.7%. However, significant insider selling over the past three months raises some concerns about internal confidence in future performance.

Overview: Foxtons Group plc is an estate agency offering services to the residential property market in the United Kingdom, with a market cap of £191.78 million.

Operations: The company’s revenue segments include £41.84 million from sales, £103.78 million from lettings, and £9.10 million from financial services.

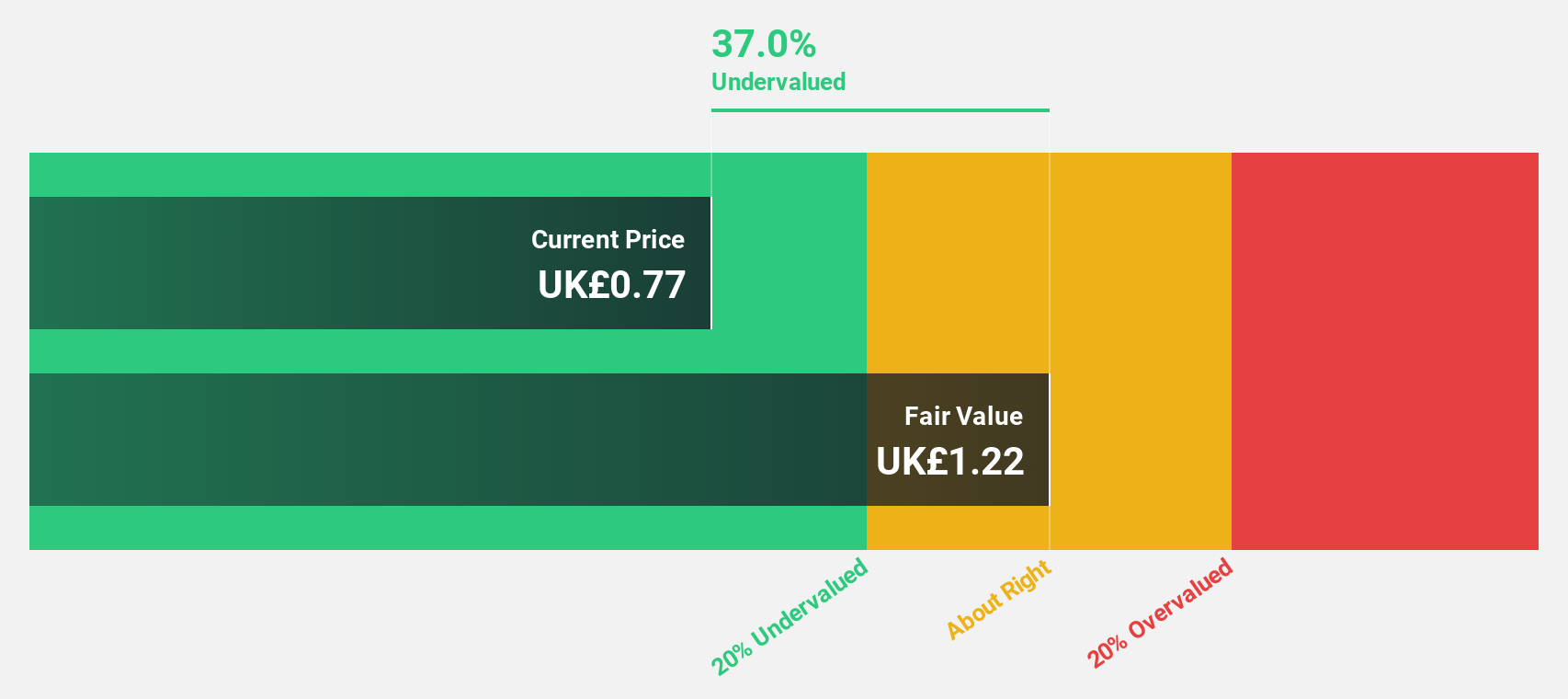

Estimated Discount To Fair Value: 47.8%

Foxtons Group (£0.63) is trading 47.8% below its estimated fair value of £1.21, indicating significant undervaluation based on cash flows. Earnings are forecast to grow at 32.14% per year, substantially outpacing the UK market’s 14.4%. Recent half-year earnings showed a rise in sales to £78.52 million from £70.93 million and net income increased to £5.89 million from £4.12 million, reflecting improved financial performance despite lower profit margins compared to last year.

Turning Ideas Into Actions

Curious About Other Options?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice.

It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com