World

Top 3 UK Dividend Stocks To Watch

The London stock market has recently faced challenges, with the FTSE 100 closing lower due to weak trade data from China and concerns over global economic recovery. Despite these headwinds, dividend stocks remain a compelling option for investors seeking stable income and potential long-term growth.

In this article, we will explore three top UK dividend stocks that are worth watching in the current market environment.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| James Latham (AIM:LTHM) | 5.97% | ★★★★★★ |

| 4imprint Group (LSE:FOUR) | 3.07% | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | 7.42% | ★★★★★☆ |

| Man Group (LSE:EMG) | 5.63% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 3.58% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 5.71% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.70% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.23% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.84% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.31% | ★★★★★☆ |

Click here to see the full list of 57 stocks from our Top UK Dividend Stocks screener.

We’ll examine a selection from our screener results.

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: M.P. Evans Group PLC, with a market cap of £454.43 million, operates through its subsidiaries to own and develop oil palm plantations in Indonesia and Malaysia.

Operations: M.P. Evans Group PLC generates $307.32 million in revenue from its plantation operations in Indonesia.

Dividend Yield: 4.9%

M.P. Evans Group’s dividend payments, covered by earnings (58.7%) and cash flows (64.3%), have grown over the past decade but remain volatile and below the top 25% of UK dividend payers. Recent production results show increased crude palm oil and palm kernel oil output, supporting future profitability. Additionally, a share repurchase program authorized up to £2 million worth of shares, potentially enhancing shareholder value through reduced share count and improved earnings per share metrics.

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Macfarlane Group PLC, with a market cap of £187.06 million, designs, manufactures, and distributes protective packaging products to businesses in the United Kingdom and Europe through its subsidiaries.

Operations: Revenue Segments (in millions of £): Packaging Distribution: 231.89, Manufacturing Operations: 42.06

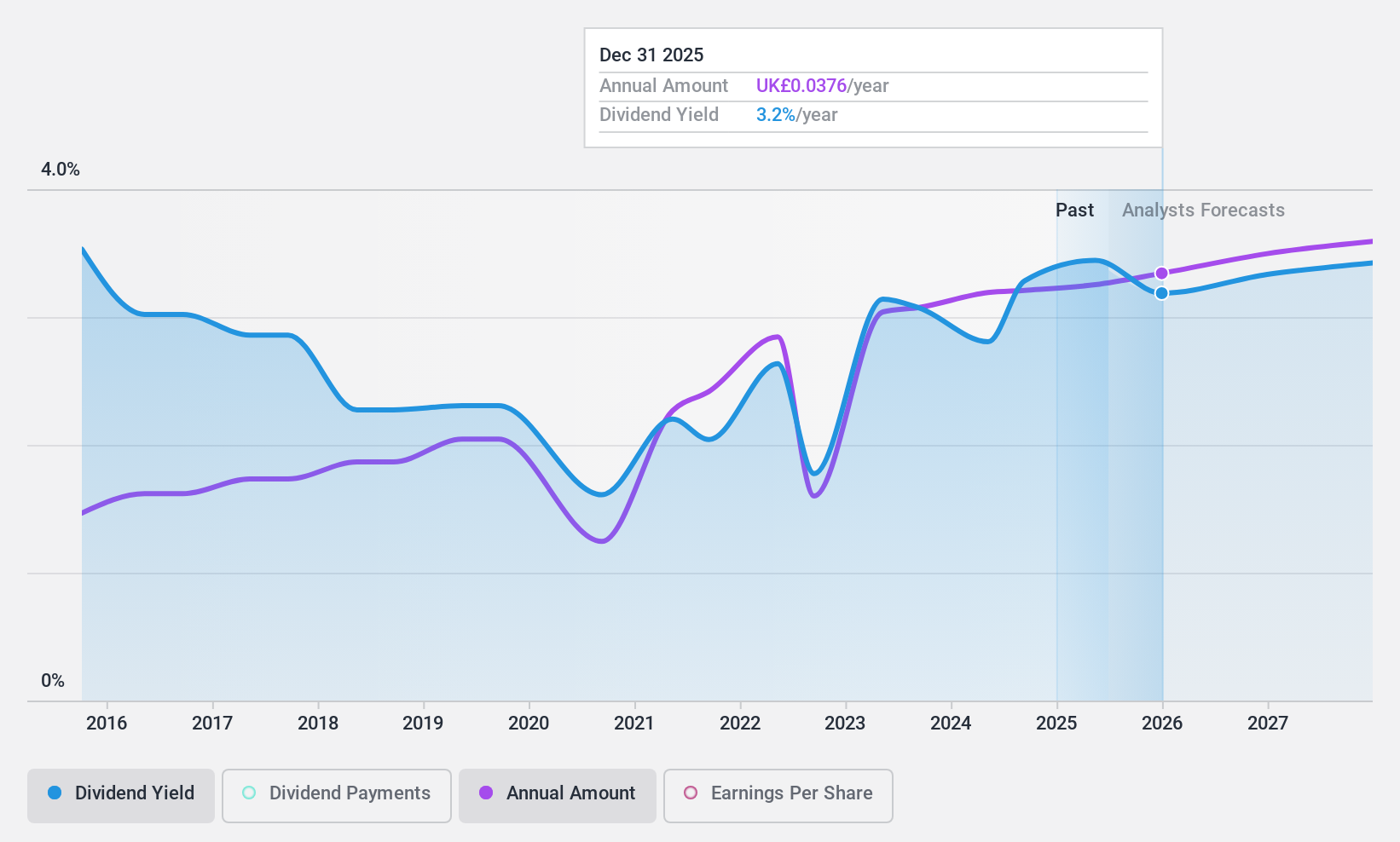

Dividend Yield: 3.1%

Macfarlane Group offers a dividend yield of 3.06%, lower than the top UK dividend payers, but its payout ratios are sustainable with earnings coverage at 39% and cash flow coverage at 22.8%. Despite an unstable dividend track record over the past decade, recent increases to 0.96 pence per share suggest potential growth. The stock trades at good value, currently 39% below estimated fair value, and analysts predict a price rise of 27.1%.

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: M&G Credit Income Investment Trust plc invests in a diverse portfolio of public and private debt and debt-like instruments, with a market cap of £135.80 million.

Operations: M&G Credit Income Investment Trust plc generates revenue primarily from its financial services segment, specifically through closed-end funds, amounting to £15.36 million.

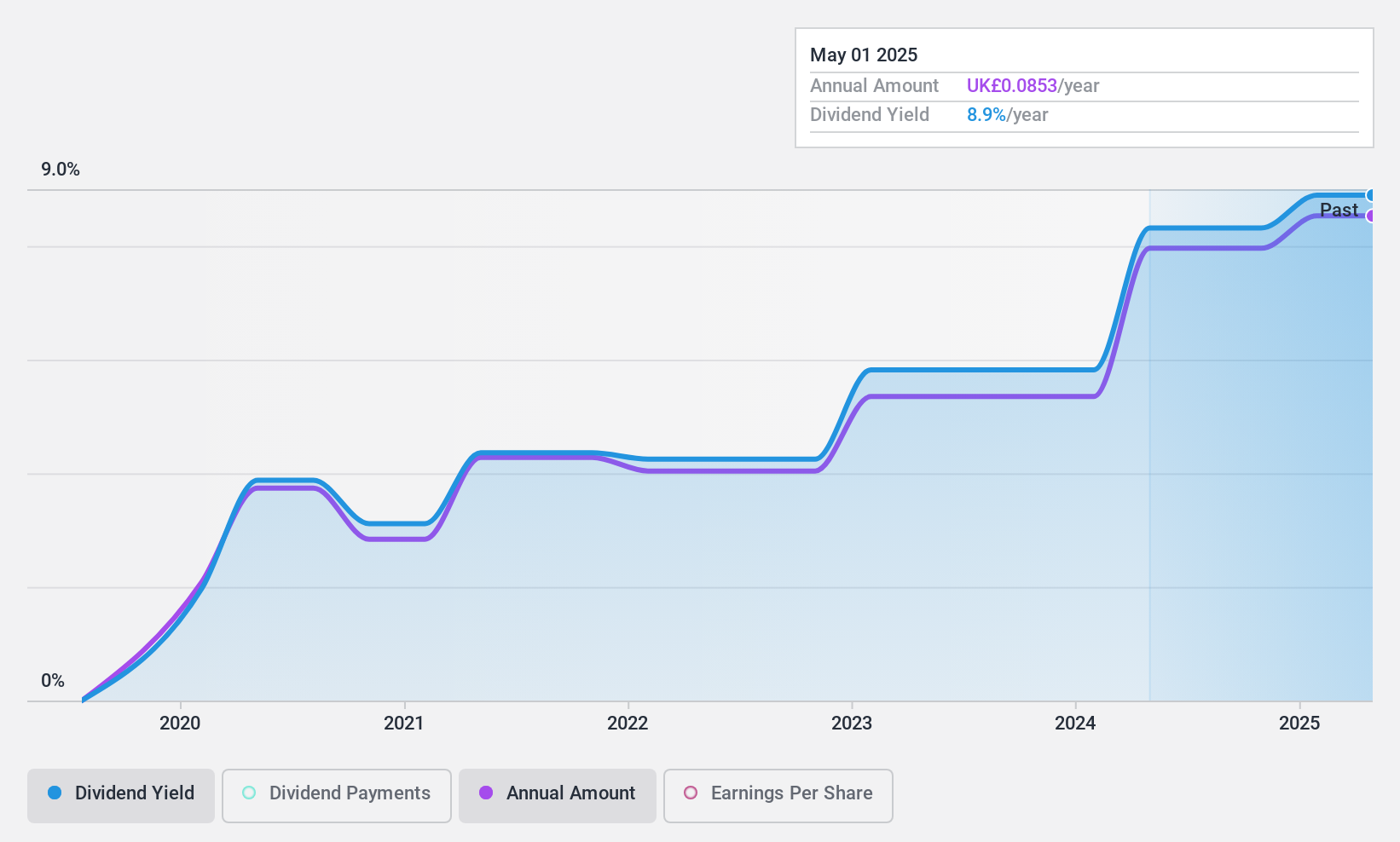

Dividend Yield: 8.4%

M&G Credit Income Investment Trust offers a compelling dividend yield of 8.36%, placing it in the top 25% of UK dividend payers. Though the company has only paid dividends for five years, recent payments have increased, including an interim dividend of 2.15 pence per share announced in July 2024. Despite a volatile and unstable track record, dividends are covered by both earnings (84.8% payout ratio) and cash flows (57.8% cash payout ratio). The stock’s price-to-earnings ratio is favorable at 10.2x compared to the UK market average of 16.9x.

Taking Advantage

- Investigate our full lineup of 57 Top UK Dividend Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It’s free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com