World

3 Top Growth Stocks With High Insider Ownership On UK Exchange

In the last week, the market has been flat, but over the past 12 months, it has risen by 10%, with earnings forecasted to grow by 14% annually. In this context, identifying growth companies with high insider ownership can be particularly appealing as they often signal strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

|

Name |

Insider Ownership |

Earnings Growth |

|

Filtronic (AIM:FTC) |

28.6% |

33.5% |

|

Gulf Keystone Petroleum (LSE:GKP) |

12.1% |

74.6% |

|

Integrated Diagnostics Holdings (LSE:IDHC) |

26.7% |

23.5% |

|

Helios Underwriting (AIM:HUW) |

23.9% |

14.7% |

|

LSL Property Services (LSE:LSL) |

10.8% |

33.3% |

|

Belluscura (AIM:BELL) |

36.1% |

113.4% |

|

B90 Holdings (AIM:B90) |

24.4% |

142.7% |

|

Velocity Composites (AIM:VEL) |

27.6% |

188.7% |

|

Judges Scientific (AIM:JDG) |

11.9% |

27.5% |

|

Hochschild Mining (LSE:HOC) |

38.4% |

53.8% |

Here’s a peek at a few of the choices from the screener.

Simply Wall St Growth Rating: ★★★★☆☆

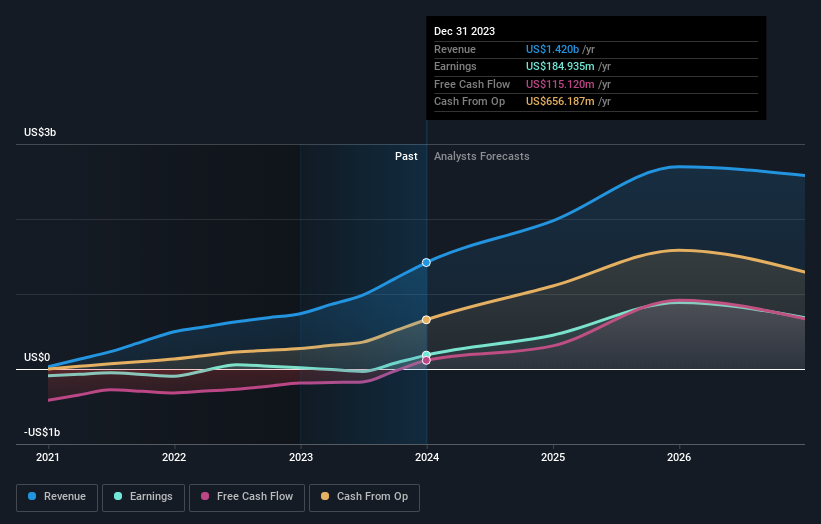

Overview: Energean plc is involved in the exploration, production, and development of oil and gas, with a market cap of £1.76 billion.

Operations: Energean’s revenue from oil and gas exploration and production is $1.42 billion.

Insider Ownership: 10.6%

Earnings Growth Forecast: 14.6% p.a.

Energean plc, a growth company with high insider ownership, has seen significant recent developments. The successful start-up of the Cassiopea field offshore Italy and the Final Investment Decision for the Katlan project in Israel highlight its expansion efforts. Despite a dividend yield of 9.44% that isn’t well-covered by earnings or free cash flow, Energean’s earnings are forecast to grow 14.6% annually, outpacing the UK market. The stock trades at 53% below fair value estimates and insiders have been net buyers recently.

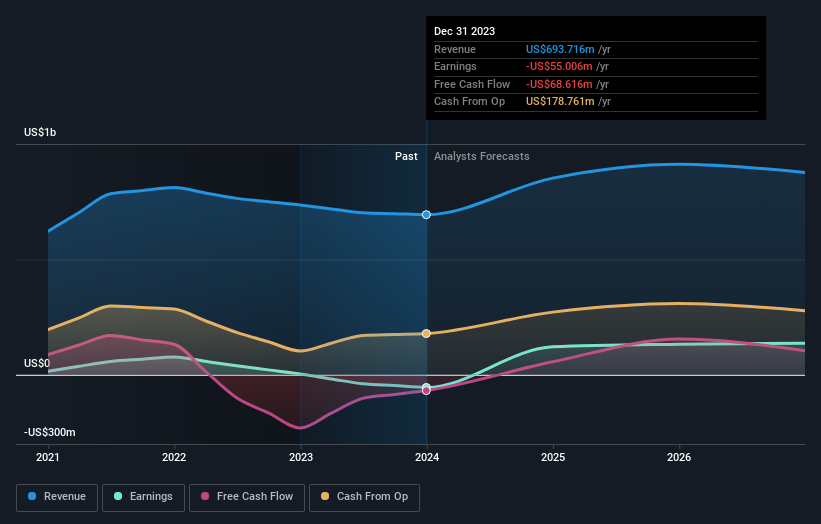

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hochschild Mining plc is a precious metals company involved in the exploration, mining, processing, and sale of gold and silver deposits across Peru, Argentina, the United States, Canada, Brazil, and Chile with a market cap of £998.05 million.

Operations: The company’s revenue segments are derived from San Jose ($242.46 million), Inmaculada ($396.64 million), and Pallancata ($54.05 million).

Insider Ownership: 38.4%

Earnings Growth Forecast: 53.8% p.a.

Hochschild Mining is forecast to become profitable within three years, with earnings expected to grow 53.78% annually and revenue at 11.1% per year, outpacing the UK market’s growth rate. Recent insider activity has shown substantial buying rather than selling over the past three months. The stock trades at 35.5% below its estimated fair value. Recent half-year results reported sales of US$391.74 million and a net income of US$39.52 million, reversing a prior loss.

Simply Wall St Growth Rating: ★★★★☆☆

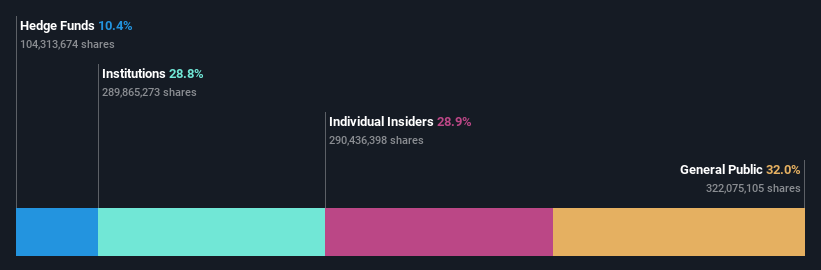

Overview: International Workplace Group plc, with a market cap of £1.83 billion, offers workspace solutions across the Americas, Europe, the Middle East, Africa, and the Asia Pacific through its subsidiaries.

Operations: The company’s revenue segments include $1.29 billion from the Americas, $1.69 billion from Europe, the Middle East and Africa (EMEA), $341.30 million from Asia Pacific, and $400.56 million from Worka.

Insider Ownership: 25.2%

Earnings Growth Forecast: 115.8% p.a.

International Workplace Group is expected to see earnings grow 115.85% annually, with revenue increasing by 7.7% per year, outpacing the UK market’s growth rate. The company recently reported a net income of US$16 million for H1 2024, a significant turnaround from a previous loss. Insider activity shows more buying than selling in the past three months. Analysts project a stock price rise of 27.1%.

Seize The Opportunity

Looking For Alternative Opportunities?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include LSE:ENOG LSE:HOC and LSE:IWG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com